INGENUITY

IN ACTION

and funds

investments in 2023

completed (as of 12/31/2023)

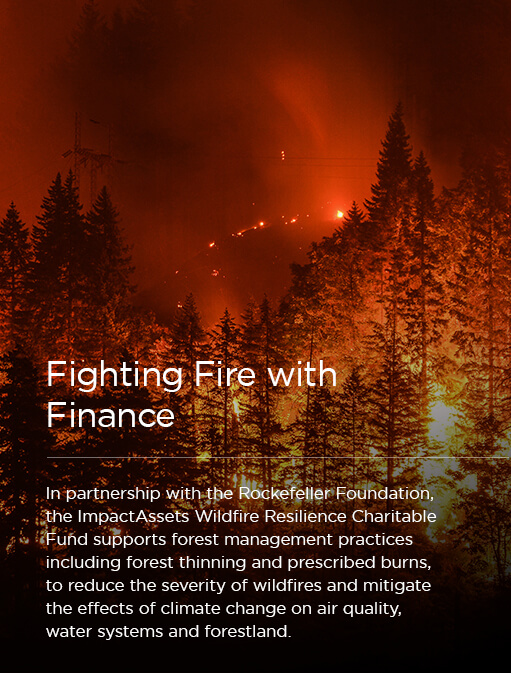

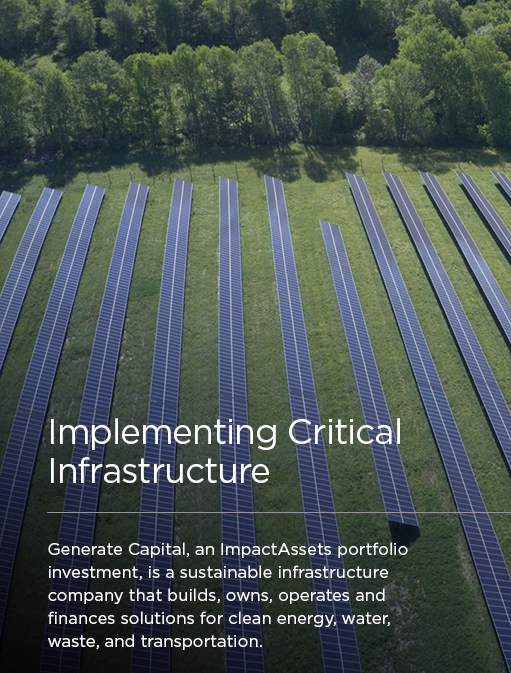

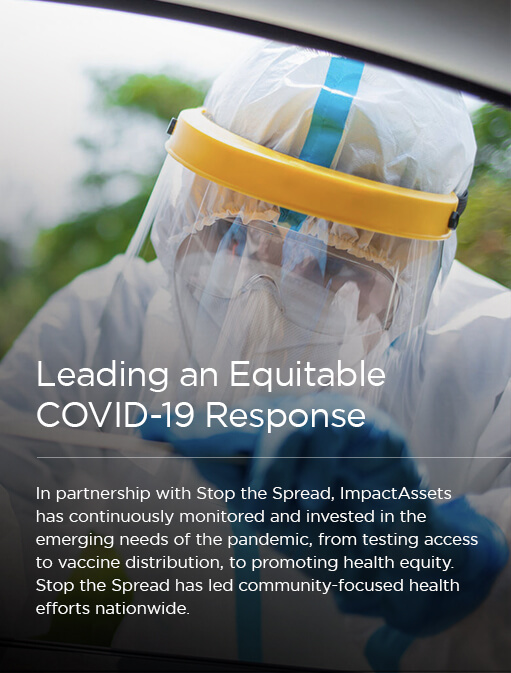

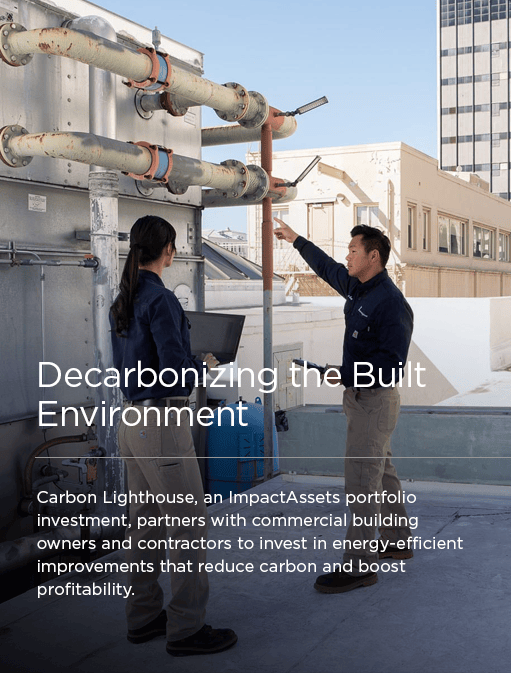

At ImpactAssets, we aim to fulfill our organizational vision—to change the trajectory of our planet’s future and improve the lives of all people—by using the full breadth of our impact investing capabilities to tackle challenging issues. We use our creativity and expertise to develop a structured, research-driven approach. Starting with in-depth research to understand capital flows to determining critical funding gaps to developing targeted investment strategies, we identify the best levers to drive positive impact.

Our donors give to a wide range of charitable causes. In fact, in 2024 alone ImpactAssets’ clients recommended a record 13,500 grants to nonprofits. These grants went to organizations across all 10 broad categories of the National Taxonomy of Exempt Entities (NTEE).

Leading giving categories by ImpactAssets donors included:

- Human Services (e.g. food programs, housing, crime prevention)

- Public & Societal Benefit (e.g. community development, human rights, and scientific research)

- Disaster Response (medical care, search and rescue, basic needs),

- Education & Schools (e.g. early childhood, K-12 schools, adult education)

- Environment and Animals (e.g. public spaces, land conservation, wildlife preservation)

Interested in learning more about how you can align your grant making and impact investing work?